Considering hydrogen is the most abundant, fundamental element in the universe, it engenders no end of engineering complexity. Its potential as both a clean energy vector and a mode of storage has seen it hailed by many as a key pillar of the energy transition. Others, however, see it as a massive, inefficient folly driven largely by the fossil fuel giants, eager to continue selling us chemical fuels of whatever stripe they can, regardless of environmental credentials or practicality.

In 2022, global hydrogen production was valued at over $155 billion, with that figure expected to grow at an annual rate of around 10 per cent through to 2030. Virtually all of this hydrogen – 99 per cent – is derived from fossil fuels, predominantly steam methane reforming of natural gas. For every ton of hydrogen produced this way – known as grey hydrogen - 10 tons of CO2 is released into the atmosphere. If the CO2 is captured, the hydrogen is referred to as blue, something the oil and gas majors have a particular interest in, for obvious reasons.

There is a rainbow of other colour-coded hydrogen variants, including turquoise (methane pyrolysis), pink (nuclear-powered electrolysis) and gold (mined from deep within the Earth’s crust). As mentioned, no shortage of complexity. Ultimately, however, a sustainable hydrogen economy will need to deliver green hydrogen, whereby renewable energy is used to power electrolysis, splitting water into hydrogen and oxygen. Surplus off-peak renewable power – think strong overnight winds – is often held up as the ideal companion for this green hydrogen future.

As is often the case with R&D, the UK can claim to be a leader in fundamental hydrogen technology, though is perhaps falling short when it comes to implementation. In July 2023, this year’s MacRobert Award – the UK’s most prestigious prize for engineering innovation – was presented by the Royal Academy of Engineering to Ceres Power. Spun out of Imperial College in 2001, Ceres has long been a leader in the development of solid oxide fuel cells (SOFCs), an electrochemical technology that converts hydrogen (and other fuel sources, including hydrocarbons) into electrical power.

Ceres has recently invested millions to tweak its core SteelCell technology so that it can now also work in reverse, acting as an electrolyser that produces hydrogen using electricity. It’s fair to assume this latest development played a key role in winning over the MacRobert panel. Chair of that panel, Professor Sir Richard Friend, hailed it as “a huge game changer for hydrogen generation”, saying the conversion losses were the lowest he has ever seen.

Inputting ambient air, 150°C steam and electricity, the SOEC (solid oxide electrolyser cell) produces hydrogen with close to 90 per cent efficiency, according to Ceres. This is significantly higher than existing electrolysis technologies and could be a major step towards making green hydrogen price-competitive with its grey counterpart.

One key factor driving that efficiency is the high temperature at which the SOEC operates, hitting around 600°C. Combining the technology with existing industrial processes, where heat is a byproduct, promises even greater gains. By 2025, Ceres says it hopes to produce hydrogen at a levelised cost of $1.5/kg, comparable to the cost of grey hydrogen today.

“Ultimately, the USP of our technology is that it’s so much more efficient if you have waste heat or heat in the system, and a lot of big industrialised systems do,” Dr Caroline Hargrove, Ceres Power’s chief technical officer, told The Engineer. “When you do, you start with at least 20 per cent more efficiency than PEM (Proton Exchange Membrane) and alkaline (electrolysis). And that’s the market that we want to go after.”

“Our CapEx is a bit higher, but because the efficiency is so much better, the levelised cost of hydrogen is also so much better with this technology. Therefore industries that are 24/7-on really benefit from that, and these are the type of industries that hydrogen is core to decarbonise.”

Those industries include steel, chemicals and e-fuels, where production takes place on a vast scale and huge amounts of heat are available. Having formerly held the CTO role at McLaren Applied, Hargrove has experience overseeing technology transfer to a variety of sectors. She joined Ceres in 2018 as a non-executive director and was appointed CTO in 2021, just as the company was investing millions into evolving its offering to include hydrogen production.

Ceres’ SteelCell technology is well established for fuel cell operations and has licensing partnerships in place with industrial giants including Bosch, Doosan and Shell. Adding electrolysis into the mix may well be a ‘game changer’, but as with all new technologies, it needs to prove itself in the field.

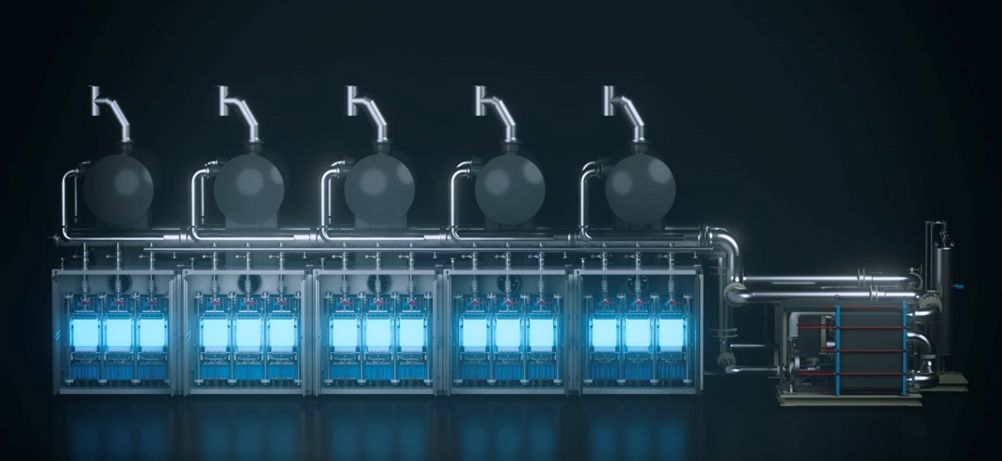

The company is currently developing two MW-scale SOEC demonstrator units. The first is due to be delivered to Shell’s Bangalore R&D centre in November 2023. The second is being developed in partnership with Linde and Bosch, sited in the latter’s Stuttgart heartland. Operational in 2024, the two-year demonstration will assess SOEC’s suitability for large scale industrial applications.

“(Bosch) will be doing this alongside Linde Engineering in order to see how it works,” said Hargrove. “Like everything else, they want to see it work in electrolysis mode.”

Data from the two demonstrators - assuming it lives up to the hype - will then be used to pitch other clients. These containerised MW modular units could then form the backbone for much larger deployments.

“There’s interest in the market and they want to see proof points,” Hargrove continued. “What we’re working on in the background is what would a 100MW plant look like, because that’s the kind of amount that you need in an industrial context.”

Ceres may have designs on the 100MW scale, but there is a UK hydrogen player already at that point. Sheffield’s ITM Power – also in partnership with Linde - is building electrolysers for two 100MW projects for Germany’s RWE, set to be powered by offshore wind from the North Sea.

“We are building two 100MW projects for RWE at Lingen – the biggest PEM electrolysers in physical build today,” Pedram Pazouki, ITM’s product & engineering director, told The Engineer.

“The UK and Germany announced their first bi-lateral agreement on 26 September, which happened to be on hydrogen, and which underlines both countries’ belief that an effective hydrogen economy will play a critical role in the energy transition.”

Pazouki came across to ITM from Linde in early 2023. Much of his work since then has been focused on Poseidon, ITM’s new 20MW PEM electrolyser module. Having gradually built its capabilities since it was founded over 20 years ago, ITM opened its Sheffield gigafactory in 2021. Poseidon now marks the next step-change in the company’s ability to deliver on industrial-scale hydrogen projects.

“Poseidon is a modular core electrolysis process unit – a building block enabling scale up,” said Pazouki.

“It consists of skid-mounted units which can be prefabricated and pre-tested. This leads to reduced deployment times and low project costs. For a 400MW project for example, whether that be for indoor or outdoor installation, 20 Poseidon modules would be coupled.”

As both Ceres and ITM can attest, Germany is ahead of most in terms of electrolysis deployments. Recently, the country doubled its 2030 green hydrogen target to 10GW. The UK also a has 10GW ‘low carbon’ hydrogen target for 2030, though that is expected to be a mix of both green and blue, with much riding on improved carbon capture technology.

Ceres’ Hargrove may have skin in the game on the green side of the equation, but also believes carbon capture has a role to play. What’s vital, says the CTO, is that grey hydrogen is phased out as quickly as possible. This would not only cut emissions, it would also provide the right market signals to the clean hydrogen ecosystem.

“I would push for – not just in the UK, but all of the EU at the very least - to give a date for banning grey hydrogen,” said Hargrove. “Push CCS, which we desperately need as well. Because as part of the mix, we need better carbon capture technology.”

Hydrogen today acts predominantly as a feedstock for things like ammonia and methanol, as well as in oil refining, where it is used in hydrocracking heavy petroleum sources into lighter fractions. This hydrogen is almost exclusively consumed at the point of production, stored only for short periods as a compressed gas or a cryogenic liquid.

The steam methane reforming that drives today’s hydrogen economy accounts for almost two per cent of global greenhouse emissions. Even if a wider, more exotic hydrogen economy – one powering transport, green steel, and domestic heating – doesn’t come to fruition in the way many envisage, existing hydrogen production will still need to be decarbonised. But for hydrogen to truly take off, innovative storage methods will be essential.

One UK company taking on the storage challenge is H2Go Power. Its core technology is a solid-state, highly porous nanoparticle-based material that essentially acts as a hydrogen sponge. A patent-pending reactor module is certified to operate between 1-10 Bar and below 100°C, storing 1kg of hydrogen that can deliver 16 kWh of electrical energy. Scaled up and paired with electrolysers, containerised units will be capable of providing long-term, grid-scale storage, according to the company.

“We’re agnostic to what we integrate with,” said Dr Enass Abo-Hamed, co-founder & CEO of H2Go Power. “We don’t have a single blue hydrogen (project) today in the company, but our system is also colour agnostic.

“We don’t build electrolysers, but we can integrate them into an end-to-end system or integrate our technology into existing systems.”

Alongside its storage technology, H2Go has also developed an analytics platform that predicts the best time to generate and use hydrogen. Known as HyAI, the analytics system is integral for maximising the potential of H2Go’s storage hardware and can also integrate with third-party infrastructure, according to Abo-Hamad.

“HyAI, alongside our smart hardware storage system, addresses the unique operational challenges that come with system design, production, storage, distribution and conversion of hydrogen as a commodity,” she said.

“This is a SaaS platform. We have commercial customers working currently on some of the largest hydrogen projects in the world, multi gigawatts, using HyAI to optimise the design of the project so decisions can be made based on intelligence.”

This kind of intelligence will be vital if hydrogen has a prominent role to play in future energy systems. As renewables expand, the potential for ‘wasted’ generation also increases. Having outlets that can soak up and store excess clean power at any time of day or night will be essential.

“Maybe the (long term) solution is everything needs to move to electricity…but on that journey, hydrogen’s got a massive part to play in helping, I think,” Greg Howett, co-founder and CEO of The First Element, told The Engineer. “We can’t control when it’s windy, we can’t control when it’s sunny.

“There’s wind farms in Scotland – for want of a better word - throwing electricity away. They haven’t got consumers for it at the right times. And that’s a problem that’s only going to grow as we try and get more of the grid on to renewables.”

The First Element’s answer to this problem is the Smart Tank, which combines hydrogen production, storage and release in a single package designed for domestic use. The IoT-enabled device will track the price of electricity, generating hydrogen via electrolysis with cheap off-peak power.

“I’m on Octopus. I pay 5p at night and I pay 35p in the daytime. So there’s a massive differential,” said Howett.

Having studied robotic engineering at university, Howett previously set up an advanced networking software business before founding The First Element in 2021. One of his co-founders is Professor Nigel Brandon, Dean of Imperial’s Faculty of Engineering and also a co-founder of Ceres Power back in 2001. Brandon has decades of experience in fuel cells and electrolysers, but The First Element is working with third parties on the Smart Tank’s storage component, which is a metal hydride carrier.

“On the hydride side, we’ve partnered with Professor David Grant, who’s at the University of Nottingham. And David is one of the authorities on metal hydrides,” said Professor Brandon.

Delivering all this affordably at consumer scale is a daunting task however. Electrolysers, for example, typically have expensive components like chemical membranes as well rare earth elements such as platinum and iridium.

“A lot of the technology relies on these rare earth metals,” said Howett. “We want to scale this business, we want to have hundreds and hundreds of thousands of these tanks. How do we find an electronic solution that’s affordable?”

According to Howett, an Oxford-based partner has a patent on a new type of copper nanotube catalyst that requires no iridium or platinum.

“If they can successfully develop that into a product that’s reliable and that can last, then that could be an amazing opportunity,” he said.

The First Element is currently developing a prototype Smart Tank, which it expects to unveil in the coming months. Resembling a mid-sized fibreglass propane bottle, it packs an impressive amount of technology into a tidy footprint.

Howett readily admits that electrification should be the first port of call in the energy transition. However, he believes there are numerous use cases where it is simply not an option, and the Smart Tank could fill those gaps.

“We’re working with some progressive holiday parks,” he said. “One’s got 45,000 units. They all run on LPG. They’re the biggest consumer of bottled gas in the UK. They cannot get any more electricity to site. They’re all remote sites, they’ve got single phase power and they can’t get upgraded. They know that LPG is going to be banned, but what are they going to do?”

Despite the UK’s National Infrastructure Commission (NIC) recently ruling out hydrogen as a viable technology for domestic heating, Howett believes many niche cases will still exist. Once the Smart Tank is ready, the First Element plans to host a launch event showcasing it generating hydrogen, as well as powering a boiler and fuel cell. Howett is also keen on the idea of a hydrogen BBQ, something that first inspired the idea for the Smart Tank.

“It’s the ultimate sort of cooking gas,” he said. “It burns nice and hot. It’s beautifully clean. It produces water vapour that improves the food moisture.

“I want to cook my sausages on hydrogen.”

From decarbonising industry to moist bangers, hydrogen supposedly does it all. Now it’s time to deliver on the hype.

More on green hydrogen

- https://www.theengineer.co.uk/content/opinion/comment-how-to-facilitate-hydrogen-s-breakthrough/

- https://www.theengineer.co.uk/content/news/elcogen-awarded-hy2-tech-funding-to-accelerate-green-hydrogen-production

- https://www.theengineer.co.uk/content/news/green-hydrogen-production-pilot-for-north-sea/

- https://www.theengineer.co.uk/content/in-depth/growing-a-green-gas-giant-innovations-in-hydrogen-production/

Guest blog: exploring opportunities for hydrogen combustion engines

"We wouldn't need to pillage the environment for the rare metals for batteries, magnets, or catalisers". Batteries don't use rare...