The Finnish corporation has a long history across the maritime and energy sectors, providing power solutions for vessels of all sizes for nearly a century. Its new report - Sustainable fuels for shipping by 2050 – the 3 key elements of success – outlines how the shipping industry can transition to greener fuel sources in the coming years, charting a pathway to price competitiveness.

Related content

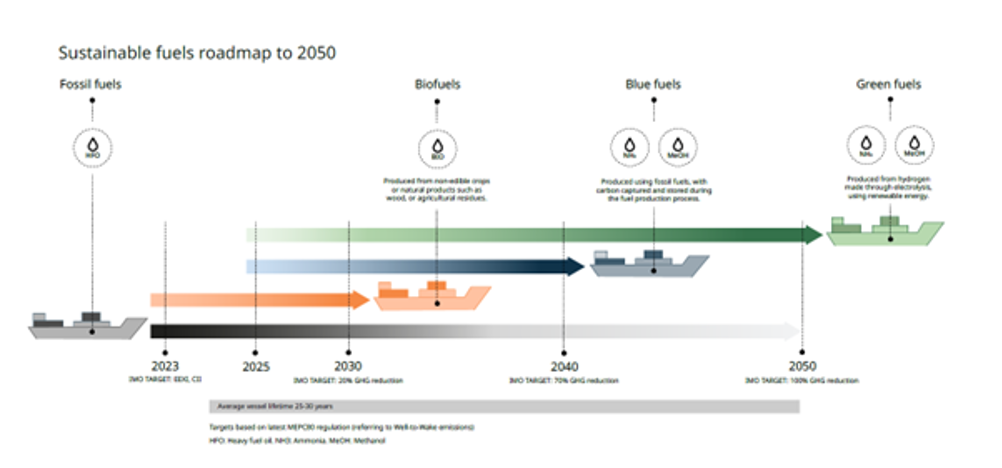

According to Wärtsilä, LNG (liquid natural gas) is likely to act as a transition fuel, followed by biofuels in the 2030s. ‘Blue’ fuels including blue ammonia and methanol – derived from fossil fuels but with carbon capture - will then act as bridging fuels. ‘Green’ synthetic fuels produced using renewable energy are predicted to become widely available at scale by the late 2030s and early 2040s.

However, the company’s modelling predicts sustainable fuels will be 3-5 times more expensive than fossil fuels in 2030. Closing that gap will require policy on marine fuel carbon pricing, binding science-based targets for phasing out fossil fuels, and international collaboration to roll out infrastructure for alternative fuels.

"Achieving net zero in shipping by 2050 will require all the tools in the toolbox, including sustainable fuels,” Roger Holm, president of Wärtsilä Marine said in a statement.

“As an industry, we must focus on coordinating action across policymakers, industry and individual operators to bring about the broad system change required to quickly and affordably produce a mix of sustainable fuels. Policy in Europe is showing just how impactful action at the international level can be, closing the cost gap between fossil- and low-carbon fuels for the first time.”

According to Wärtsilä, shipping is suffering from a “chicken and egg” scenario whereby operators will not commit to alternative fuels without more certainty around cost and availability, while suppliers cannot invest in production capacity without stronger demand signals from operators. Overcoming this challenge will require clear policy and a joined-up approach across the sector. However, Wärtsilä also said that operators can take actions now around fuel efficiency and future-proofing their vessels for alternative fuels.

“If there is one take away from our report, it is that smaller operators need not feel powerless,” said Holm.

“They have a major role in accelerating towards net-zero emissions shipping. Taking steps to improve fuel efficiency and invest in fuel flexibility can deliver immediate returns, reducing both emissions and operating costs. But action must be swift – we have the lifecycle of just a single vessel to get this right.”

McMurtry Spéirling defies gravity using fan downforce

Ground effect fans were banned from competitive motorsport from the end of the 1978 season following the introduction of Gordon Murray's Brabham...