The research, developed in partnership with Norwegian Offshore Wind and World Forum Offshore Wind (WFO), surveyed 184 floating offshore wind stakeholders on industry sentiment and attitudes across the value chain.

The survey revealed a lack of standardisation of floating technology (55 per cent), manufacturing capability and capacity (51 per cent) and port infrastructure (50 per cent) as the most cited major hurdles and risks to progress for floating offshore.

With this, Westwood said that calls are ringing out for governments to provide more specific policy and regulatory support for technology development, in addition to cost reduction and investment in port infrastructure to accelerate adoption.

It was also found that 42 per cent of European respondents were less optimistic about the floating offshore wind sector than they were two years ago, compared with 30 per cent for non-Europe.

Globally, 44 per cent of developers were found to be more optimistic about the sector than two years ago, whereas that decreased to just under a quarter of supply chain respondents, potentially pointing to a lag in projects coming to tender for their services.

Additional analysis from Westwood’s WindLogix solution found that the recent market upheaval caused primarily by cost inflation, together with the subsequent refocusing of developer strategies, will mean global floating offshore targets will all be missed.

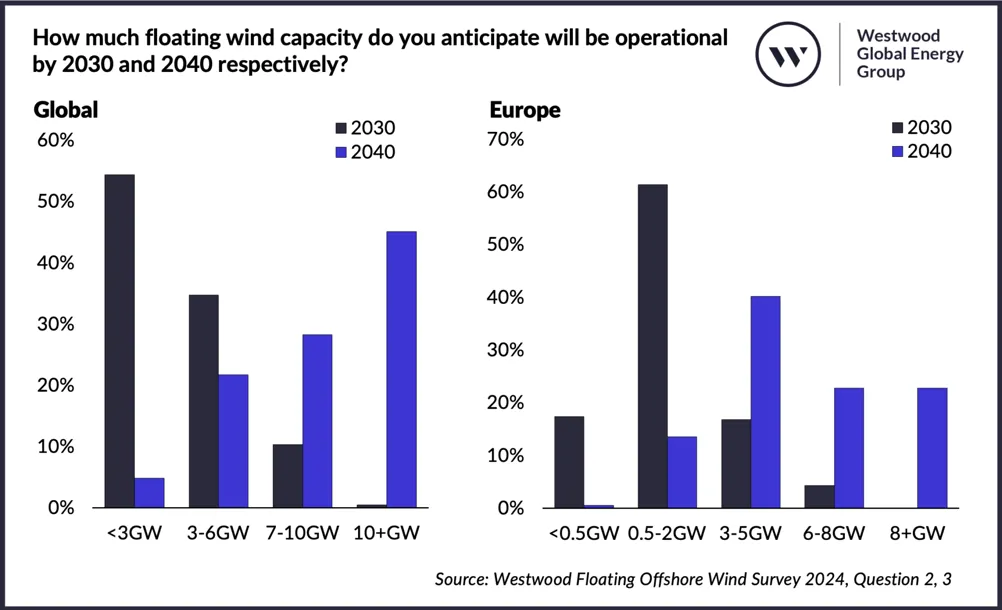

Most respondents (54 per cent) said they expect less than 3GW of global capacity to be operational by 2030, with Europe reaching 0.5-2GW in the same timeframe (61 per cent).

In a statement, David Linden, head of Energy Transition at Westwood, said: “These are significant and familiar challenges for an industry in infancy, as first-movers look to establish reliable supply chains and weigh up investment risk. But despite these known obstacles and a more realistic picture of near-term growth, optimism hasn’t wavered as much as anticipated. The enthusiasm accompanying the flurry of activity following the 2022 leasing rounds and target setting has naturally waned, but our survey results demonstrate the appetite in the sector.

“Right now, it’s a question of pace. While the UK is still heralded as a clear front runner of floating offshore wind’s future, chosen by 71 per cent of responders, it needs to deliver. We’re also seeing South Korea and China building out their respective supply chains, and other countries such as France making some bold commitments, resulting in diverse views on the achievable pace of growth in the run up to 2040. Direct investment in infrastructure and technology coupled with more focused policy are likely to be pivotal pace setters.”

The survey, released yesterday (May 29, 2024) at Norwegian Offshore Wind’s Floating Wind Days in Haugesund, Norway, can be downloaded here.

Visit our jobs site https://jobs.theengineer.co.uk/ to find out about some of the latest career opportunities at industry's biggest employers

IET sounds warning on AI doll trend

I agree that we need to reduce cooling water demand for servers. And yes, generative AI consumes a large amount. But what about BitCoins? Their...