Coming at a time when millions in the UK are struggling to heat their homes and put food on the table, the record profits announced by energy firms in recent weeks have led to renewed calls for a tougher UK windfall tax on fossil fuel firms.

BP’s announcement of a £23bn profit in 2022 (more than double its previous year’s figures) reflects a wider earnings bonanza in a sector that has benefitted from the high fossil fuel prices driven by Russia’s invasion of Ukraine. On February 2nd, 2023, Europe’s largest oil and gas company Shell announced profits of almost $40bn (again more than double its previous year’s figures), whilst ExxonMobil and Chevron have also reported bumper earnings.

Energy firms operating in the UK already face a windfall tax: the so-called Energy Profits Levy, an additional tax on UK oil and gas “extraordinary profits” that currently stands at 35 per cent. However, critics of the scheme claim that as the levy only applies to selected profits it doesn’t go far enough and that it should be revamped to cover more of the earnings made by energy companies.

In response, industry bosses have claimed the high prices are necessary to drive the required investment in the transition to a low carbon economy, a claim somewhat undermined by the additional news that BP is scaling back plans to reduce the amount of oil and gas it produces by 2030.

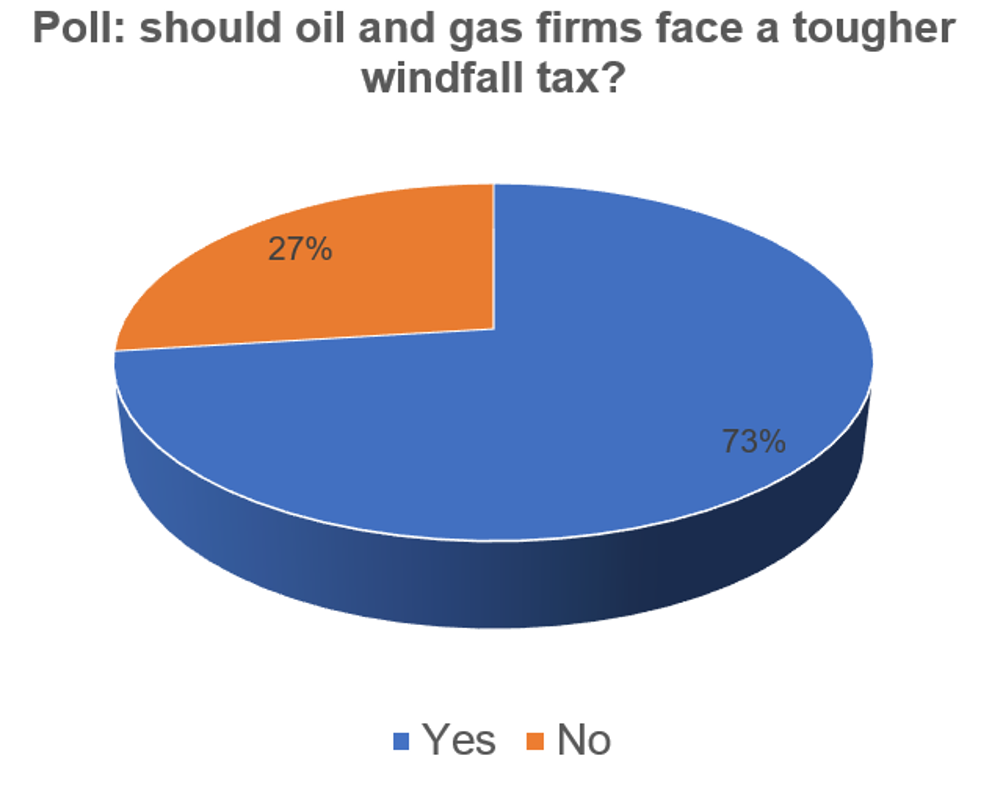

In this poll we asked a simple question - do you think the windfall tax should be strengthened? Yes or no? The poll is now closed, but your comments are still welcome. Please note, all comments are moderated.

Breaking the 15MW Barrier with Next-Gen Wind Turbines

Hi Martin, a wind turbine blade functions very much like an airplane wing in a climb. Obviously in one case the air is moving and the other the air is...