Change is sweeping through the automotive industry. Tesla – founded by two Silicon Valley software engineers less than 20 years ago – is now the world’s most valuable car company, worth more than Ford, BMW and Toyota combined. And it’s by no means the only recent arrival that’s shaking things up.

Not even the rarefied world of mega-money hypercars is immune. Croatian engineer Mate Rimac was just 19 years old when he started building electric cars in his garage in 2009. Last year, his company Rimac Automobili, bought Bugatti – builder of the world’s fastest road cars, and a brand that can trace its name back well over a century.

In this brave new world, the key players don’t necessarily come from traditional automotive backgrounds. And those that do may be looking for ways to short-cut the lengthy process of adopting new technology – especially where low-volume halo projects are concerned.

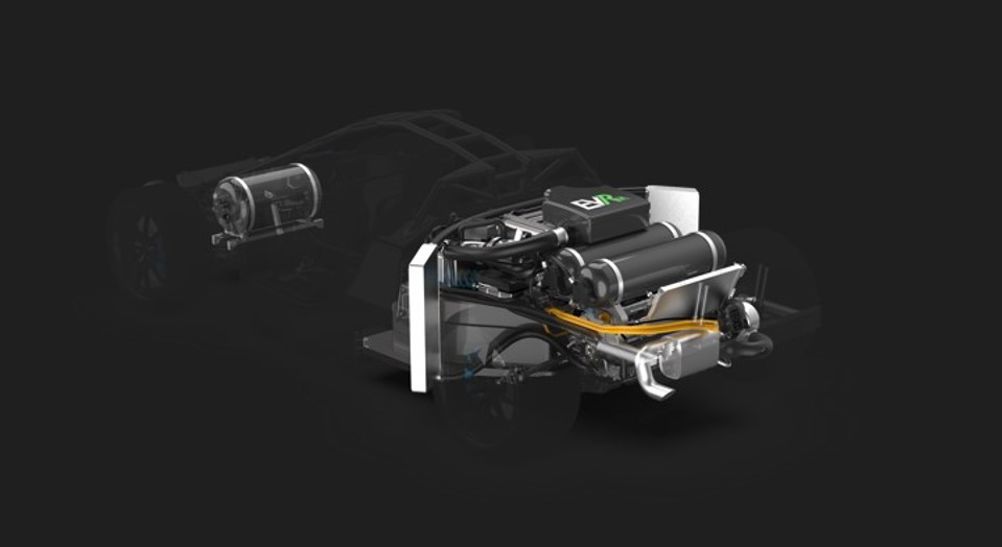

Step forward Williams Advanced Engineering (WAE). Established in 2010 as an offshoot from the hugely experienced Formula 1 team, the company has used its expertise in electric vehicle technology and composite structures to create an ultra-high performance vehicle platform, known as the EVR. This can be scaled to provide anything from a standalone powertrain to a complete rolling chassis, ready to be clothed in the customer’s bespoke bodywork.

The specifications are eye-watering. The EVR’s state of the art lithium ion battery pack is capable of supplying up to 1,650kW (2,180bhp) and yet the complete car can weigh less than 1,800kg. That equates to roughly the same power-to-weight ratio as a modern Formula 1 car, while the option of four-wheel drive promises sub-2 second nought to 60 mph times. Top speed is projected to be in excess of 248mph (400kph), with fast charging in sub-20 minutes giving a range of more than 279 miles (450km).

Such outrageous figures are all part of the game with electric hypercars. The Lotus Evija, Tesla Roadster and Pininfarina Battista all promise four-figure power outputs and similar sprint times. Where the EVR differs is that it’s not really a car as such, but a set of components that can be tailored to the specific needs of OEMs looking to build their own creations.

“In the early days of the automotive industry you’d start off with a chassis, add a powertrain and then the body and the interior might be put on by an external coachbuilder. We’ve effectively flipped that around, so we start with the battery and work outwards from there,” comments Chris McCaw, chief engineer for vehicle integration at WAE and the technical lead for the EVR project.

The WAE engineers start with what they term the high voltage (HV) chassis. This consists of the battery, the motors and the associated high voltage electronics. The next level is a rolling chassis, complete with carbon fibre monocoque tub, plus front and rear subframes holding the suspension, brakes and steering. WAE can provide things like front and rear roll structures, and even a functioning cockpit and interior, so all the customer has to do is provide their own bodywork. Conversely, some may simply want the HV chassis or the battery.

Adaptability

One of the key targets was to maximise the flexibility of the platform – not just to accommodate vehicles of different shapes and sizes, but also to provide fundamentally different attributes. This begins with the monocoque, which is comprised of around 12 different composite components bonded together. By modifying these sections, it’s possible to create fixed head coupés, targa-roofs and convertibles from the same basic set of components. Likewise, the shape of the doors and the hinge arrangement can be changed without re-designing the whole tub, while the front and rear subframes accommodate changes to the wheelbase and track.

The battery is a load-bearing component, placed behind the cockpit, where you’d find the combustion engine in a traditional supercar. It has been designed specifically to contribute to the structural strength of the platform.

“By applying this holistic approach we can add 20 to 30 per cent stiffness to the overall structure. Or, to flip that around, if it’s a lightweight two-wheel drive design we can take out 20 to 30 per cent of the adjoining structure to reduce the weight of the vehicle,” notes McCaw.

This is where the EVR’s flexible architecture really starts to come into play. In its lightest form, the platform is two-wheel drive, with twin rear motors providing electronic torque vectoring; the next step is to add a third motor driving the front wheels via a limited slip differential giving four-wheel drive; finally, there’s the option of a twin motor setup on the front enabling fully independent control of the torque to all four wheels.

Even in its simplest form, the EVR uses software-configurable brake-by-wire, steer-by-wire and torque vectoring. The end result is that it’s possible to tailor the driving experience from one vehicle to the next even with the same underlying hardware.

“Over the last few years we’ve seen a number of electric hypercars coming to the market with quite similar specifications. Everyone wants 2,000bhp and 1.9 seconds nought to 60mph. What’s going to differentiate them is how they feel,” comments McCaw. “Someone who’s buying a million-pound hypercar doesn’t want it to feel like another product that’s been re-skinned. It has to be unique in the way that it drives. We’ve got a very accomplished vehicle dynamics team here at Williams that can engineer that for the customer or work with their own vehicle dynamicists to get the attributes that they want.”

WAE is no stranger to this way of working. Its previous projects include partnering with Jaguar to engineer the C-X75 plug-in hybrid hypercar, which was developed and launched in just 18 months – a third of the timescale for a typical OEM programme.

Hydrogen option

These days most of the European manufacturers are shifting their focus towards battery electric vehicles. However, that’s not the case in all markets. Earlier this year, WAE was sold to Australian industrial group Fortescue, which includes green hydrogen specialist FFI. This has prompted the Oxfordshire-based firm to investigate hydrogen for use in both fuel cell and combustion engine applications.

“We want to take the opportunity to explore the use of hydrogen in a lightweight high-power vehicle,” comments McCaw. “It remains to be seen whether it really provides the best solution for this type of hypercar at the moment. From a pure performance perspective, we think batteries are currently the more optimal solution, but working with a fuel cell system and seeing how we would need to manage the power output of that compared to a battery-only system is really interesting.”

The concept that WAE is working on halves the EVR’s battery capacity to around 40kWh but adds a 100kW fuel cell that functions as a range extender, topping up the battery as it drives. This results in a vehicle that’s 50 to 100kg heavier but capable of travelling an extra 100km or so, taking the total range to more than 340 miles (550km).

“Hydrogen fuel cells are not particularly power-focused, so it becomes a question of balancing range against power,” notes McCaw. “If you want a large amount of instantaneous power you’re going to need a large battery and probably less hydrogen, but where a fuel cell starts to come into its own is if you have a long-distance GT car where the emphasis is on range. And that’s something that we can see generating a lot of technology transfer – for instance, taking lessons learned about managing that energy balance in a hypercar and then applying it to a hundred-tonne mining truck.”

The company has already completed the packaging design for a hydrogen fuel cell variant of the EVR, complete with high pressure hydrogen tanks. A similar exercise is planned for a hydrogen combustion variant, which raises the prospect of zero-carbon motoring combined with the visceral involvement of an IC engine.

All these will be playthings for the mega rich. But these low-volume high-value niche projects give engineers an opportunity to investigate new ideas that could one day percolate into the mainstream. And with the industry frantically reinventing itself, that could happen sooner rather than later.

Guest blog: exploring opportunities for hydrogen combustion engines

"We wouldn't need to pillage the environment for the rare metals for batteries, magnets, or catalisers". Batteries don't use rare...