Given it accounts for about 90 per cent of world trade, shipping’s 3 per cent share of global greenhouse gas emissions could be seen as decent business. Nonetheless, that 3 per cent translates to around one billion tonnes of CO2 each year. If the shipping industry was a country, it would rank as the sixth worst polluter in the world, behind only China, USA, India, Russia and Japan.

Unlike a country, however, the maritime sector cannot rely on electrification to kickstart its energy transition. Some short haul ferries and coastal vessels are already adopting battery electric, but ocean-going tankers and container ships won’t be following suit any time soon. As new EU emissions regulations come into force – and with an International Maritime Organisation (IMO) net zero target of 2050 on the horizon – shipping operators are exploring a patchwork of different solutions to chip away at the sector’s heavy carbon footprint.

“There are a lot of opportunities in shipping to reduce energy consumption,” Juha Kytölä, director of R&D and Engineering at Wärtsilä, told The Engineer. “Already the step from liquid fossil fuels to natural gas use is a great step forward. So there we can say that we are able to achieve 20 per cent reduction on greenhouse gas emissions.”

Replacing heavy fuel oil with liquid natural gas (LNG) won’t win too many plaudits from environmentalists, but it is symptomatic of the piecemeal approach that the shipping sector is faced with. Traditionally risk averse and slow to adopt new technologies, the maritime industry also operates on thin margins, generally lacking the kind of slush fund cash other sectors may be able to funnel into decarbonisation efforts. Add in ships with lifecycles that can run over multiple decades, and you can see why the sector is taking the long view on decarbonisation.

Producing ammonia from e-based or electrically produced hydrogen…is a really sustainable solution for shipping or other areas where power and energy is needed

A recent report from Wärtsilä outlined what that extended pathway to net zero shipping could look like, with different flavours of sustainable fuels powering the journey at various stages. According to the company, LNG will act as a transition fuel for the near future, with the use of biofuels expanding in the 2030s.

“Many plants already in the world are actually creating biogas,” said Kytölä. “So, the same assets, the same ship, using natural gas can start operating with biogas with no modifications. Or they can start to blend in the biogas into the natural gas and by that get the gradual positive development in decarbonisation.”

Wärtsilä expects the supply of biofuels to grow in the coming years and has designed marine engines with them in mind, capable of operating with a variety of fuel inputs. In time, it anticipates blue fuels – derived from hydrocarbons but with carbon capture – will be the next step in decarbonisation. These blue fuels, including blue ammonia, will help bridge the gap to green fuels, which the company predicts will not be available at scale until the late 2030s at the earliest.

“Ammonia is a great chemical because it does not contain carbon at all,” said Kytölä. “Producing ammonia from e-based or electrically produced hydrogen…is a really sustainable solution for shipping or other areas where power and energy is needed.”

Whereas biofuels can act as a ‘drop-in’ replacement for existing petroleum products, the same cannot be said for ammonia. The chemical is very much a known quantity in terms of handling and storage, with an existing global market of around 150 million tonnes per year. This market currently relies almost exclusively on fossil fuel feedstocks, the ‘grey’ ammonia going on to supply the fertiliser market as well as industrial applications including plastics, explosives and synthetic fibres. But giving ammonia a new lease of life as an energy vector throws up several challenges.

“It’s a good energy carrier,” said Kytölä. “However, the energy density in ammonia is not as good as it is with fossil liquids like diesel. It takes in the ship around 3.8 times more space…so you need a bigger tank.”

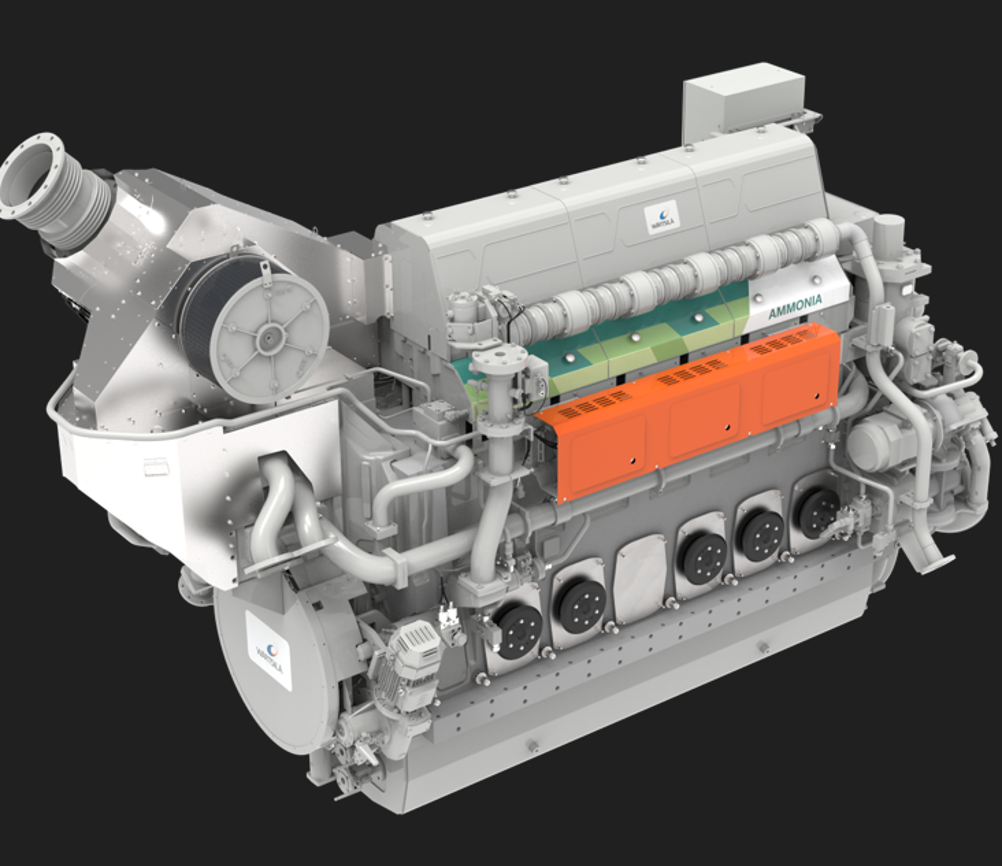

Asking ship owners to dedicate nearly four times more space to carrying a new, more expensive fuel than they currently use sounds like a tough pitch. But Wärtsilä and its customers know which the way the wind is blowing, and in November 2023 the company launched the marine sector’s first commercially available 4-stroke ammonia engine. Based on the existing fuel-adaptable Wärtsilä 25, the ammonia-capable engine is said to reduce emissions by more than 70 per cent compared to diesel, despite needing a bit of assistance to get going.

“When it comes to the combustion behaviour of ammonia, ammonia is what we call a lazy fuel,” said Kytölä. “Compared to diesel fuel or gas fuel, some more energy needs to be put there to get it combusting…but with good control and good ignition, we can get very, very smooth combustion.

“We have tested combusting in gaseous mode, and we have also tested combustion in liquid mode, so that we learn which would be the best for the for the operations.”

For ammonia-powered shipping to be sustainable in the long term, the chemical (NH3) will need to be produced using renewable electricity. The first step is to split green hydrogen from water using electrolysis. More green electricity is then needed to power the Haber process, where the hydrogen and nitrogen (harvested from air, of which it makes up 78 per cent) are reacted together at high temperature and pressure to produce ammonia.

While other electrically derived or ‘e’ fuels such as green methanol are also being explored by the maritime sector, ammonia currently looks the likeliest hydrocarbon replacement. A 2024 study from Oxford University found that just 10 regional hubs supplying green ammonia could decarbonise up to 60 per cent of global shipping emissions. The Oxford team estimated that green ammonia demand in 2050 could be three to four times the current grey ammonia output – approaching somewhere close to a billion tons per year.

Virtually all of this green ammonia production is predicted to lie within 40° latitudes North/South, with the largest investment needed in Australia to supply the Asian markets. Production clusters are also predicted in Chile to supply South America, California to supply the Pacific coast of the US, North-West Africa to meet European demand, and the southern Arabian Peninsula to meet local demand as well as parts of south Asia. The Oxford study estimated that $2 trillion will be needed to transition to a green ammonia fuel supply chain by 2050.

“Shipping is one of the most challenging sectors to decarbonise because of the need for fuel with high energy density and the difficulty of coordinating different groups to produce, utilise and finance alternative fuel supplies,” said René Bañares-Alcántara, Professor of Chemical Engineering in at Oxford.

“Under the proposed model, current dependence upon oil-producing nations would be replaced by a more regionalised industry; green ammonia will be produced near the equator in countries with abundant land and high solar potential then transported to regional centres of shipping fuel demand.”

Some aspects of the ammonia supply chain are of course already mature, but using the chemical as a fuel throws up plenty of technical hurdles. For its part, Wärtsilä has invested in R&D around ammonia logistics, exploring aspects of safety and certification as well as the fundamentals of how to get the fuel from dockside to ship.

“We have had a lot of focus on the safety concept as well,” said Kytölä. “We have developed ways to not only use it in the engine, but we have developed ways how to fill up the tank in a ship - to bunker ships - so to load in ammonia. How to handle the tank systems - we have products now for ammonia tanks. How to lead it from the tanks to the engine and how to create safety around the engine.”

Greener methods of propulsion are understandably the primary focus when it comes to charting a course for net zero shipping, but they are by no means the only game in town. Given the timescales for green fuels expected by Wärtsilä and the wider industry, many operators are eyeing the low hanging fruit available today. With an interim IMO target of 40 per cent emissions reductions below 1990 levels by 2030, the sector is embracing a range of solutions beyond the engine room.

Fleet renewal by itself can have a subtle but powerful effect on emissions, with new ships averaging around 20 per cent energy efficiency improvements on previous generations. And according to Kytölä, it is not just the latest vessels that can aspire to big gains. Digitalisation tools and fleet management can have an impact for ships of all ages, tailoring bespoke routes and optimising speed to maximise efficiency.

“Energy efficiency can be greatly improved and not only for new vessels, but also for existing,” Kytölä said. “There are measures to optimise the use of these assets…they don’t need to rush through the oceans with full speed in order to be too early in the harbour, where they wait for days in order to get their pier place.”

Other efficiency solutions include air lubrication, where a coating of bubbles eases the passage of a ship’s hull through the water. Though results vary from vessel to vessel, it’s claimed the technology can reduce emissions by 10 per cent. Even more impactful are rotor sails – also known as Flettner rotors - which use the Magnus effect created by large, vertical spinning cylinders to boost propulsion. It’s claimed rotor sails can reduce fuel consumption and emissions by up to 30 per cent. According to Kytölä, the tools needed to hit the IMO’s 2030 target are readily available today.

“Yes, it is possible,” he said. “All the opportunities and the technologies exist already today. So 40 per cent is possible.

“I would say that there is a great speed up in very many segments that we see. So it looks positive…we need both that willingness, but we probably do need to see a little bit of regulations as well. This indeed is taking place already in some of the areas. In the EU there is the Emission Trading Scheme, ETS, being planned.

“And we don’t believe this will stay only in Europe. As in other regulations we’ve seen, other areas will follow.”

Starting from 2024, the ETS obligates all passenger and cargo vessels of 5,000 gross tonnage (GT) and above to account and pay for their emissions when sailing to or from an EU port. Initially, just 40 per cent of a vessel’s CO2 emissions will be liable, but this will rise to 100 per cent by 2027, with methane and nitrous oxide added to the calculations from 2026.

The legislation is meant to apply the ‘polluter pays principle’, meaning that the cost of pollution is borne by those who create it. But with truly green fuels still decades away, the options available to shipping companies to dramatically cut emissions are limited.

“We don’t think that ships are going to run on methanol or ammonia in the next few decades, like 20 years, let’s say. The fuel supply just isn’t there,” said Roujia Wen, co-founder & CTO of maritime tech startup Seabound.

“And even when the supply is ready, that only works for new ships, whereas you’ve got all these existing ships running on the water today. And they’re still burning fossil fuel.”

The solution, according to Seabound, is carbon capture. It recently completed a pilot test of its calcium looping carbon capture technology on a 240m container ship off the coast of Turkey, successfully capturing 78 per cent of CO2 from a portion the vessel’s exhaust gases. Lab tests have demonstrated capture rates as high as 95 per cent.

“We managed to achieve 78 per cent, which we think is already very good, because a lot of the IMO regulations are ramping up every year,” Wen told The Engineer. “95 per cent is sort of our goal to work towards. And it’s been proven possible on land-based calcium looping plants.

“Right now, there’s still not a huge amount of incentive for ship owners to capture all of the emissions onboard a ship. So 78 per cent - it’s definitely really good from a customer perspective.”

Founded in late 2021, Seabound has already attracted prominent investors, including Y Combinator, Lowercarbon Capital, and Eastern Pacific Shipping. Wen’s background is in theoretical physics, studying at Cambridge. She and fellow co-founder Alisha Fredriksson - both alumni of the Silicon Valley-backed Minerva University - have no formal maritime background, relying instead on a startup mentality that drove them to identify a fundamental problem awaiting a solution.

“We kind of started with the problem rather than a particular technology,” said Wen. “We wanted to solve the problem of maritime decarbonisation and we were looking into different ways to capture CO2 onboard a ship.”

From the outset, Wen and Fredriksson observed that other maritime carbon capture systems were separating out the CO2 entirely, which then had to be stored onboard at -50° C and 7 bar. These aren’t quite cryogenic levels, but they’re enough to have significant cost implications.

“That’s just really capital intensive and energy intensive and it’s just really hard to handle liquid CO2 on board ships and hard to discharge them at ports as well,” said Wen.

Rather than trying to solve the entire process, Seabound instead chose to focus its efforts on the first step of CO2 capture, binding the gas chemically with calcium. Calcium oxide is used as a sorbent to strip CO2 from flue gases. The resulting calcium carbonate pebbles are stored onboard, then offloaded at ports either for further processing to harvest the CO2 or sold for building materials.

“We found that calcium oxide is the best material in terms of the weight ratio for capture of CO2, but also just the technology maturity level and the abundance of the material,” said Wen.

“There is no heat input. So the sorbent is exothermic. It takes in exhaust at about 300 degrees C, and then through the reaction, it’s going to maintain itself at much higher temperature as its releasing heat during the process.”

Seabound’s onboard reactor is relatively compact. However, the sorbent feedstock and resulting calcium carbonate pebbles will require a small slice of the ship’s capacity. Though this will inevitably have an impact on the economics of commercial shipping, it’s a problem common to virtually all decarbonisation technologies. Whether it’s new fuels like ammonia, rotor sails, or CCS, all solutions come with the trade-off of space.

“We estimate that it would take up between one to five per cent of the cargo capacity, depending on how much carbon we capture and the duration of the voyage,” Wen explained.

“I also think that this is a challenge that every single technology provider faces, no matter if you’re swapping fuel, or you’re trying to use batteries or like, like wind assist solutions. They all take up space and weight and that is sort of a common problem.”

Following last year’s pilot, Seabound is now gearing up for a commercial-scale trial. In true startup fashion, the company has ambitious plans, targeting 1,000 ships by 2030 and 10,000 by 2040. And with almost 60,000 vessels of more than 1000 gross tons in today’s merchant fleet, the market opportunity is certainly there. Carbon capture may not be the long term panacea for shipping’s emissions, but until green fuels become widely available, it may well be the best solution for a sector short on options.

McMurtry Spéirling defies gravity using fan downforce

What a fun demonstration. I wonder if they were brave enough to be in the car when it was first turned over. Racing fan cars would be an interesting...