The UK has more than its fair share of unsung engineering success stories, but there are perhaps few more striking examples of Britain hiding its industrial light under a bushel than its buoyant space sector. Despite a relatively low public profile, UK space is at the forefront of areas including the manufacture of telecoms satellites, the development of small systems that can be launched at a fraction of the cost of traditional technology, and the design of robotic probes and rovers for planetary exploration.

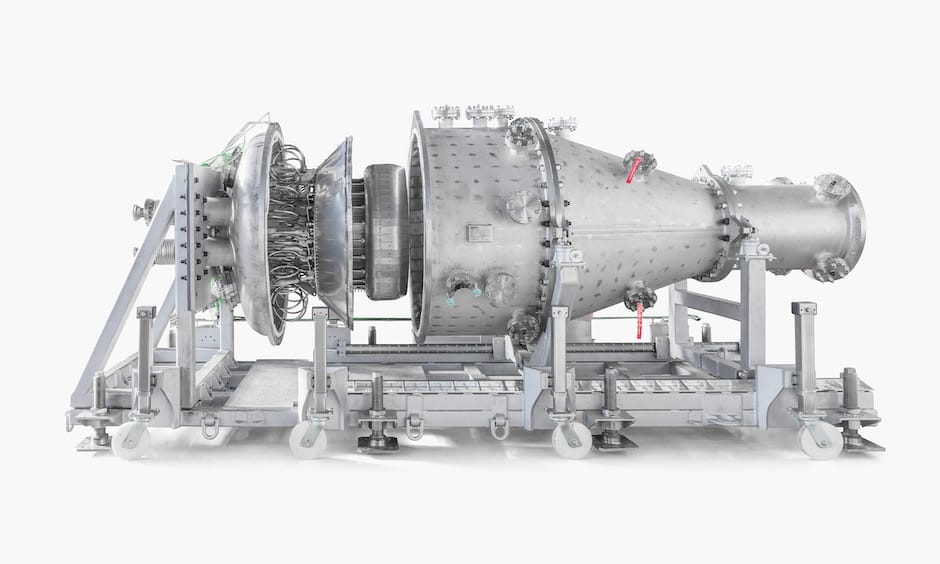

Meanwhile, with several proposed spaceports under consideration, alongside the development of innovative propulsion technologies such as Reaction Engines’ SABRE engine, the UK is even beginning to take significant steps towards the development of its own domestic launch capability.

Now made up of nearly 1,000 separate organisations – with around 30 new companies joining the fold each year – and directly contributing almost £6bn to the economy each year, the sector has tripled in size since 2000, making it one of the UK’s fastest-growing industries.

There are multiple drivers behind this success, not least the degree to which the UK has been able to draw on its existing research base, as well as the presence of established names like Airbus Defence & Space and Surrey Satellite Technology. Some credit should also go to the UK government for singling out the sector in its industrial strategy and planning the establishment of a National Space Council to oversee a joined-up approach to the sector’s growth.

But perhaps what has really defined the sector in recent years is the emergence of a host of innovative SMEs that are grabbing a share of the lucrative ‘new space’ market opened up by organisations such as Elon Musk’s SpaceX.

Nimble and small enough to react to a rapidly evolving marketplace, these rising stars of the space sector are applying new technologies in novel ways, helping reduce the cost of launching payloads into space and driving innovation across the sector.

Satellites

Perhaps the UK’s best-known area of space technology is in the development of satellites.

The sector’s largest manufacturer, Airbus Defence & Space, has manufacturing bases in Stevenage and Portsmouth and UK engineers have played a key role in projects including Galileo, the Lisa Pathfinder mission and ESA’s Solar Orbiter programme.

But in recent years it has positioned itself as perhaps the world’s leading developer of small satellites. This began with Surrey Satellite Technology – now owned by Airbus – which pioneered the development of small satellites and paved the way for a new generation of innovative space spin-outs.

One of the most exciting emerging players in this area is Glasgow’s Clyde Space.

Since its launch just over a decade ago, the company has become one of the world’s leading developers of so-called CubeSats – miniaturised satellites (around the size of a loaf of bread) which are used for space research.

The firm – Scotland’s largest space company – designed and manufactured Scotland’s first satellite, the UKube-1, which was launched from Baikonur, Kazakhstan in 2014.

Another rising star of the UK space sector is Oxford Space Systems, which has commercialised technology for lightweight carbon fibre antennas that can be stored in small packages and which spring into shape when in orbit.

With a base at Oxfordshire’s renowned Harwell Science and Innovation Campus among a cluster of more than 90 different space organisations including RAL space, Deimos Space UK, Rezatec and Neptec, the company has used ‘origami engineering’ techniques to develop a range of lightweight carbon fibre booms, antennas and panel arrays that boast the benefits of conventional satellite technology but can be launched into space at a fraction of the cost.

In 2015, the company was selected for the UK Space Agency’s AlSat Nano mission, achieving a world-first with the longest-ever retractable CubeSat boom in orbit at 1.5m.

The company’s AstroTube boom is being used as part of ESA’s RemoveDebris mission, which is evaluating technologies that could be used to address the growing problem of orbiting space junk.

Science

Away from the commercial world, UK space is perhaps best known for its scientific research base.

Landmark moments in UK space science over the decades range from Ariel 1’s solar observations in 1962 through to Tim Peake’s mission aboard the ISS. Recent marquee projects with UK involvement include NASA’s InSight Mars rover (landed November 2018) and James Webb Space Telescope (due to launch in 2021), as well as the lead role in ESA’s upcoming ExoMars rover, newly named Rosalind Franklin in honour of the pioneering British chemist.

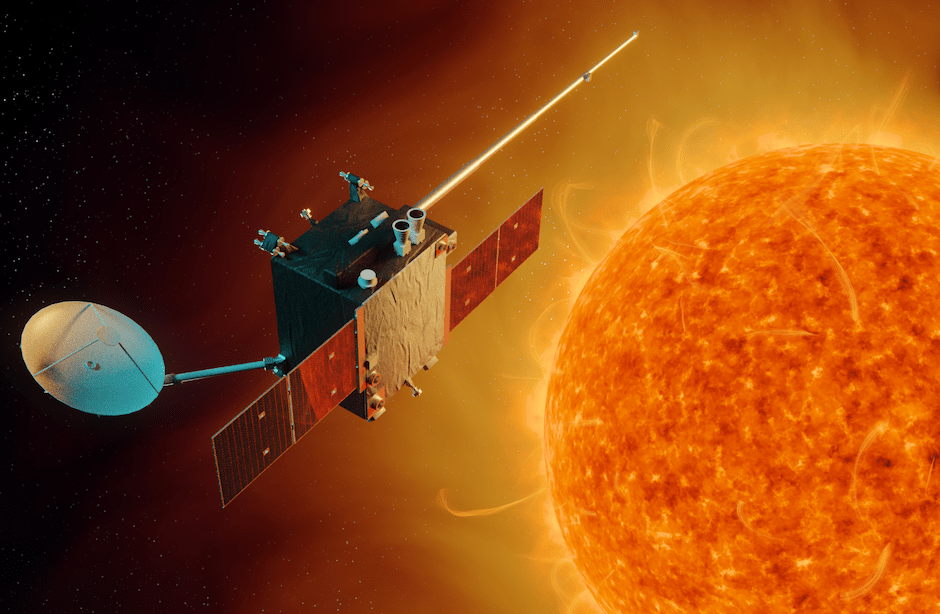

With no current launch capability of its own, it is perhaps not surprising that much UK space expertise has gravitated towards instrumentation. One fascinating project recently announced will see UCL’s Mullard Space Science Laboratory (MSSL) develop a plasma analyser for ESA’s Lagrange mission. Launched in 2024, the tool will be part of a sensor suite to monitor solar activity from the L5 Lagrange point, which forms an equilateral triangle with the Earth and the Sun.

“The plasma analyser is what is known as a ‘top hat’-type electrostatic analyser,” MSSL’s Prof Dhiren Kataria told The Engineer. “It’s going to be looking at the energy and angular distribution of solar wind ions.”

Solar storms have the potential to cause widespread global chaos, knocking out satellites and power grids. As a result, monitoring the Sun’s activity more accurately has long been a goal of the international space community, and the L5 mission will be complemented by a US spacecraft operating at the L1 point between the Earth and the Sun.

By dint of its location, the L5 mission will be privy to solar activity several days before that part of the Sun is aligned with Earth. L1 is directly between the two bodies, providing more up-to-date information, but also offering significantly less warning time for dangerous coronal mass ejections (CMEs). “If you can imagine, it gives you a kind of stereo view between L1 and L5,” Kataria explained. “You have two views and you then have a better understanding of how the CME has evolved.

“By sitting at L5, you see the active regions well before they come into visibility for Earth. You get visibility of it at least four to five days in advance.”

Other future UK missions to watch include Truths (Traceable Radiometry Underpinning Terrestrial- and Helio-Studies), an NPL-led project to enhance measurement capabilities in space; and Comet Interceptor, a bold new effort to study a pristine comet from the Oort cloud as it enters the solar system for the first time.

Spaceports and launch

Back in the commercial space, UK engineers are now looking seriously at the technology and infrastructure required to give the UK its own launch capability.

Recent years have seen a flurry of activity, with several British locations slated for both vertical and horizontal take-off, as well as new launch technologies gaining momentum.

Sutherland in northern Scotland was chosen in 2018 to be the home of the UK’s first spaceport, providing vertical launch services from the wild, remote A’Mhoine Peninsula.

Plans for the complex will see Lockheed Martin use one pad for its Electron rocket, with a second pad likely to go to British spaceflight company Orbex, which recently raised £30m in public and private funding.

Some have questioned the suitability of the Sutherland site, and another site on North Uist in Scotland’s Outer Hebrides is aiming to beat Sutherland to the punch. QinetiQ, which operates the nearby MOD Hebrides Rocket Range, is a partner in the project.

Horizontal launch has proved no less competitive, with both Glasgow Prestwick and Snowdonia’s Llanbedr Airfield muted as potential spaceports, the latter having also been in the running for vertical launch. But Newquay Airport looks set to take the lead, with Spaceport Cornwall recently being allocated £20m in funding.

Virgin Orbit will operate from the facilities and assist with the development, potentially launching small satellites in the early 2020s. Further down the line, the UK’s Reaction Engines is another possible customer. Development of the company’s ground-breaking Sabre often feels glacial, but nobody said redefining spaceflight was going to be easy.

Reaction recently marked a major milestone, however, with SABRE’s pivotal precooler heat exchanger passing hot ground tests replicating Mach 3.3, the speed record of the SR-71 Blackbird. The single-stage hybrid engine is designed to reach speeds of Mach 5.5 in air-breathing mode, before switching to rocket power to hit orbital escape velocities of around Mach 25.

Glasgow trial explores AR cues for autonomous road safety

They've ploughed into a few vulnerable road users in the past. Making that less likely will make it spectacularly easy to stop the traffic for...